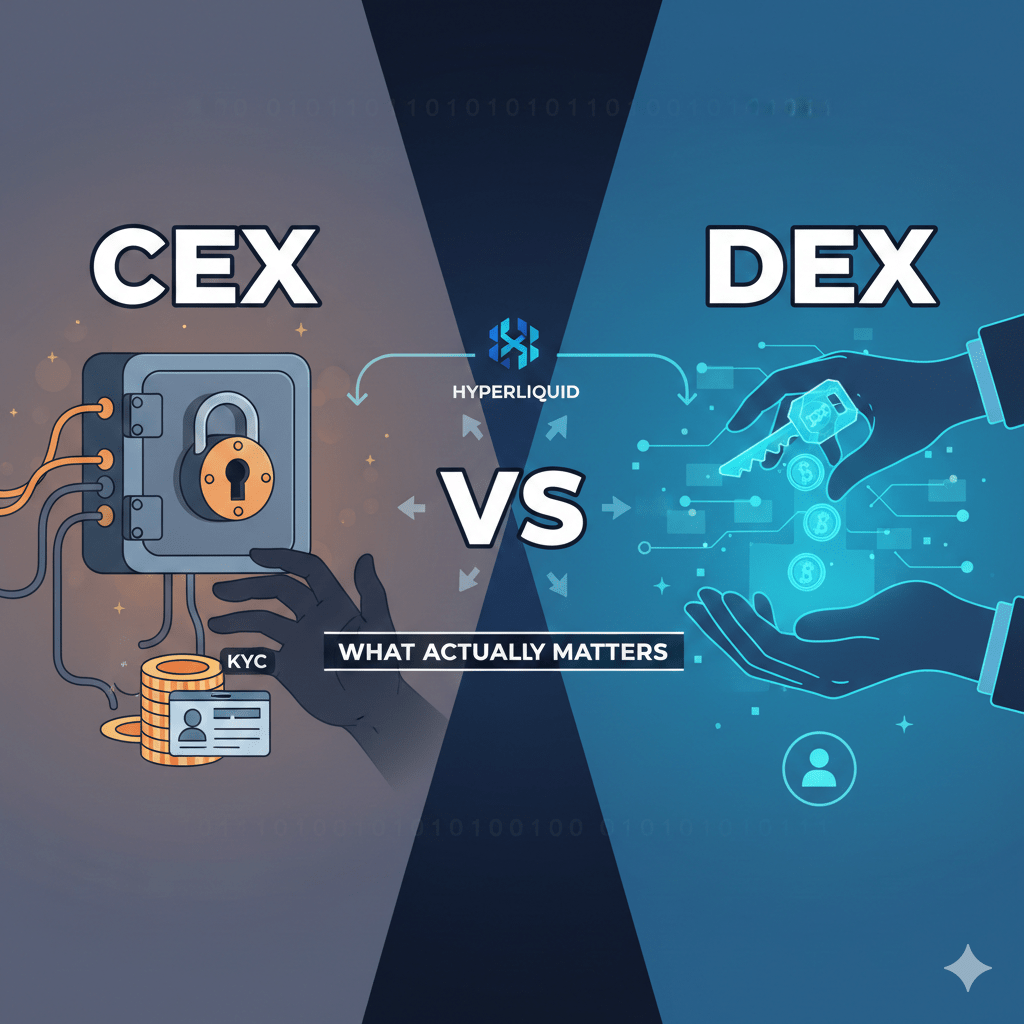

When entering the crypto market, one distinction cannot be avoided: CEX and DEX.

At first glance, both look like “exchanges.” In reality, they operate on completely different foundations. Understanding this difference changes how you relate to your capital.

What a CEX Really Is

A CEX is a centralized exchange operated by a company. Examples include Binance, Bybit, and OKX.

Users open an account and deposit funds. Trading happens inside the platform. The structure is simple and efficient. For beginners, it is often the easiest entry point.

But one premise is often overlooked: you do not control your funds.

Order books are not verifiable

CEX order books are visible, but not verifiable from the outside.

- Whether the displayed liquidity is real

- Whether internal matching is prioritized

Especially with smaller assets, the order book does not always represent real supply and demand. CEXs are convenient — but not transparent. That is their structural nature.

What a DEX Changes

A DEX operates directly on the blockchain.

You connect your wallet. Your assets remain in your own address at all times. No custody. No withdrawal suspension. No centralized control.

In exchange, full responsibility rests with the user. Freedom and responsibility exist together.

Why DEXs Used to Be Difficult

For a long time, DEXs were not practical for most traders:

- Slow execution

- High gas fees

- Poor user experience

They were functional, but not usable. That has changed.

Hyperliquid as an Exception

Hyperliquid represents a different design philosophy.

It offers order-book trading, near-instant execution, minimal fees, and fully on-chain settlement. The interface feels similar to a CEX. The structure, however, is entirely decentralized.

CEX-like usability with DEX-level transparency. That combination is rare.

Why I Use Hyperliquid

The reasons are straightforward:

- No custody risk

- Transparent mechanics

- Fixed rules that do not change mid-game

The ability to trade without trusting an intermediary matters — not for ideology, but for consistency.

Trading Fee Discount (4% Off)

If you plan to try Hyperliquid, the link below provides a 4% trading fee discount.

https://app.hyperliquid.xyz/join/MATSUBARA

No registration. No KYC. Wallet connection only.

CEX or DEX — Which Is Better?

There is no universal answer.

CEX prioritizes convenience. DEX prioritizes control. The key is awareness: knowing where your capital sits — and who can move it — matters more than most people realize.

Final Thought

Crypto is not only about price. It is about ownership.

Who controls the keys. Who can stop transactions. Who sets the rules. Once that becomes clear, DEXs stop feeling “advanced” and start feeling logical.

Hyperliquid makes that transition practical. If you are curious, experience it yourself:

https://app.hyperliquid.xyz/join/MATSUBARA

カテゴリー:トレード, English Articles, Trading